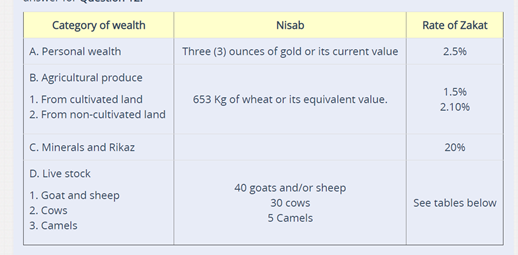

Nisab and the rate of Zakat for each category are given below. For further details, please refer to Q19 of the FAQ.

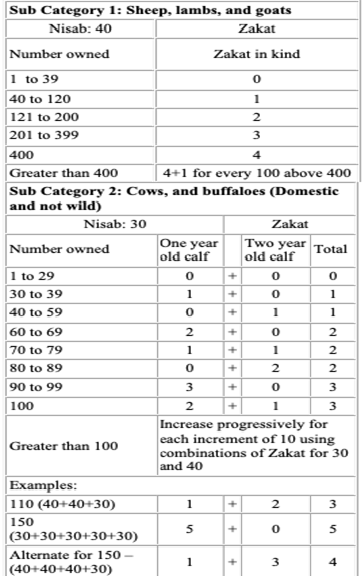

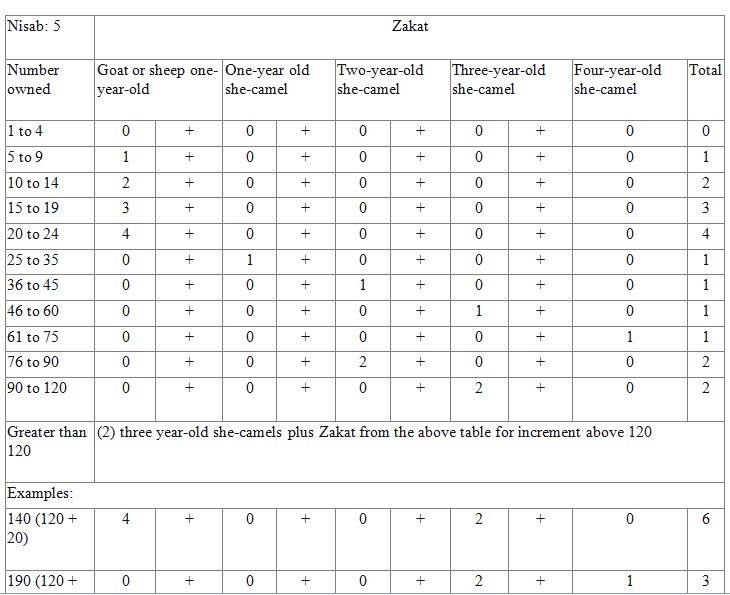

The following tables give the Zakat for the three subcategories of livestock:

Sub Category 3: Camels

Trade is defined broadly as an exchange to make a profit. Therefore, whenever the two terms (1, goods acquired with the intention of selling, and 2, goods acquired with the intention of making a profit) are present, Zakat is due. This will apply to all goods if they are acquired for trade and to make a profit (including livestock, precious stones, real estate, minerals, and other materials from the earth). If they are not acquired for trade, but they fall under the categories of livestock, agricultural produce, and rikaz (treasure unearthed), Zakat may become due for them following their nisab and Zakat calculations. However, generally speaking, assets acquired for personal use are not subject to Zakat. The above two conditions for trade goods are in addition to the general terms that apply to Zakat for non-business personal wealth (See Q19 for more details).

Definition of investments in trade goods:

When one is engaged in business, whatever its nature, one usually invests some money in the purchase of a building, furniture, and equipment, which take the form of fixed investments that are used and are not “goods for trade.” There is no Zakat to be paid on such investments that are intended for use and not for sale.

Next, there is the investment in inventory (raw material, work-in-progress, or finished goods in the case of any business that involves manufacturing or processing) and in some operating cash. These assets are subject to Zakat. During the Zakat year (one lunar year called the hawl), these trade goods are sold with resulting cash or receivables (which eventually get converted to cash after payments are received from customers). Receivables that are expected to be converted to cash during the Zakat year are also to be included as Zakat-eligible assets in calculating Zakat. This also applies to any debts that are expected during the Zakat year.

For general considerations regarding the amount loaned to others, see the answer to Q13 of this section. However, any short-term payables (amount owed to creditors and suppliers) that are to be paid during the Zakat year shall be subtracted from the assets before calculating Zakat. The profit generated on the sale is either put back (reinvested) into the business and/or distributed to the owners. The part that is distributed to the owners becomes a part of their individual personal wealth subject to its conditions of Zakat-eligibility (See Q19 for more details).

The part that is reinvested in the form of operating cash and inventory becomes part of those assets and is automatically included in Zakat calculation. Therefore, Zakat on trade goods is calculated as follows:

This business has to be operating for at least one year. If any share of the business is sold during the year, that share will not be included in the seller’s or buyer’s assets.

Valuation of assets:

The general opinion is that since prices fluctuate during the year, the valuation shall be based on the current market rates at the time of paying Zakat. In addition, the valuation shall apply wholesale rates and not the retail prices, because if any liquidation of assets is done, it will be at the wholesale rates.

Zakat year for business:

The Zakat year for a business is also one lunar year (called hawl). The Zakatable assets, as defined above, shall be at or above nisab at the end of the Zakat year.

There is another opinion that the value of Zakatable assets shall satisfy nisab throughout the Zakat year. If the value goes below the rate of nisab, a new Zakat year needs to be started after the value meets the nisab. However, the practice at the time of the Prophet ﷺ was to calculate Zakat if, at the end of the Zakat year, the value of Zakatable assets was equal to or higher than nisab.

Multiple owners:

If there is more than one owner, the net value of assets of the company that is subject to Zakat, as explained above, should be apportioned to each owner based on their share. Then each owner is responsible for calculating and paying Zakat on their share. This approach is preferred because it may exempt a partner with a small percentage from paying Zakat. The company may pay Zakat on behalf of all owners if they are all obliged to pay Zakat.

No duplicate payment of Zakat on the same assets:

As a general principle, an item is subject to Zakat only once (upon satisfying the conditions of Zakatability). For example, if a company is paying Zakat on behalf of all owners (assuming that everyone meets nisab), then no Zakat is required upon the individual owners as part of their wealth.

2. Income-generating assets (income from rental property/assets):

If one is engaged in the business of selling the use of their property/assets for income, there are differences of opinion regarding whether the value of the property/assets themselves are Zakatable or not, since they provide growth by producing revenue or profit. The stronger view is that the value of these assets is not subject to Zakat. Still, any income derived from the exploitation of these assets is subject to Zakat, provided the income received in the Zakat year meets nisab. There are differences regarding the rate at which Zakat is calculated. A modern view is that the rate of Zakat shall be either 10% or 5% on the net income in a Zakat year. This opinion is based on an analogy to the Zakat paid on the agricultural produce. However, the conservative opinion is to use 2.5% as the general rate of Zakat on the net income from rented properties during the Zakat year. We have selected this view for the Zakat calculator.

This view will also apply to rental income from any exploited assets, such as cars, jewelry, animals, etc. If the rental income for a given Zakat year is the only source of sustenance for the owner, a reasonable cost for his/her living expenses, including the living expenses of his/her dependents for the year, must be deducted. Then on the remainder amount, Zakat shall be calculated if that amount meets the value of nisab.

In case of a loan, Zakat on the amount loaned to someone is primarily the obligation of the owner of the money, and the obligation is determined based upon the following conditions.

Under the condition that they satisfy the nisab threshold, their guardian should pay Zakat on their behalf. It is incumbent upon that guardian to ensure that the money is growing; otherwise, the entire amount will be eaten up over a number of years by paying Zakat itself. Various opinions in this regard are:

The following six conditions obligate the payment of Zakat on an individual:

The Quran specifies eight (8) purposes for which Zakat can be used. They are the following:

Zakat-ul-Fitr is Zakat on the individual. Prophet Muhammad ﷺ is reported to have said “Remember Zakat-ul-Fitr is essential (wajib) for every Muslim, man or woman; free or in servitude; adult or child.” (At-Tirmidhi)

Zakat-ul-Fitr or Sadaqat-ul-Fitr is a particular charity paid to the needy on or before the day of Eid-ul-Fitr, which is the first day of the month of Shawwal following the month of Ramadan. Zakat-ul-Fitr is paid as atonement for any shortcomings in the worship of fasting during the month of Ramadan. Upon the completion of Ramadan, Eid-ul-Fitr, every Muslim possessing an amount of food above their family’s need for a day (24 hours) is mandated to pay Zakat-ul-Fitr on behalf of themself and all their dependent(s). Zakat-ul-Fitr or Fitrah is to cover one full meal per person or cash equivalent to the cost of one full meal, given directly to the needy of the community before Eid-ul-Fitr prayer. Arrangements for paying Fitrah should be made ahead of time so that it reaches the eligible recipients in time for them to make use of it on Eid day. The quantity of Zakat-ul-Fitr traditionally amounts to one Sa.` One Sa` is equivalent to 2751–3800 grams of food such as wheat, barley, rice, or the like. In Greater Chicago, the cash equivalent of Fitrah is determined by Islamic organizations to be $5.00 – $7.00 per family member. Those who are eligible to receive Zakat-ul-Fitr are the same as those who are eligible to receive regular Zakat.

Sadaqah is an Arabic term widely used to cover all kinds of charity. Although Sadaqah and Zakat are interchangeable, Sadaqah is a voluntary or optional form of charity that all Muslims are encouraged to give.

The Prophet Muhammad ﷺ once said “Every Muslim has to give sadaqah.”

The people asked: “O Prophet of Allah, what about the one who has nothing?”

He replied: “He should work with his hands to give sadaqah.”

They asked: “If he cannot find (work)?”

He replied: “He should help the needy who asks for help.”

They asked:” If he cannot do that?”

He replied: “He should then do good deeds and shun evil, for this will be taken as sadaqah” (Sahih al-Bukhari).

Muslims practice Sadaqah and earn rewards from Allah (SWT) by doing good deeds all their lives. They can continue earning Allah’s rewards even after their death should they leave any of the following legacies behind them. This charity is called perpetual sadaqah (Sadaqat-ul-Jariyah). Prophet Muhammad ﷺ is reported to have said “When a person dies (the benefit) of their deeds ends, except three: a continuous sadaqah, knowledge from which benefit is derived, or a pious child invoking Allah for him” (Sahih Muslim & Ahmad).

Etiquette of Giving Sadaqah